Real-time payments offer numerous benefits for both consumers and companies given their convenience and immediacy. They should be at the heart of treasury as it transitions from a batch to a realtime environment.

Jerzy Piatek,

EMEA Product Manager, Domestic Payments, Treasury and Trade Solutions, Citi

The pace of our everyday lives has accelerated in the past decade as smartphones have revolutionized how we communicate, shop, bank and access information. Increasingly, we live in a 24/7 world where we might check our bank balance at midnight or place a groceries order by mobile during a morning workout. Instant payments, which are a fast and convenient payment method, have helped to facilitate this new world. From a corporate standpoint, instant payments are also transforming corporate practices, enabling faster and lower cost collection methods.

The emergence of payments that are transmitted and settled within seconds is prompting many companies to re-examine their treasury models. Concepts like cut off times or end-of-day statements are becoming redundant in the new “always-on” business environment where e-commerce is gaining ground. While most instant payment systems in EMEA initially targeted consumers, with relatively low payment thresholds, increasing value thresholds are being introduced in many schemes, making instant payments increasingly relevant to the B2B payment ecosystems.

How instant payments have entered the mainstream

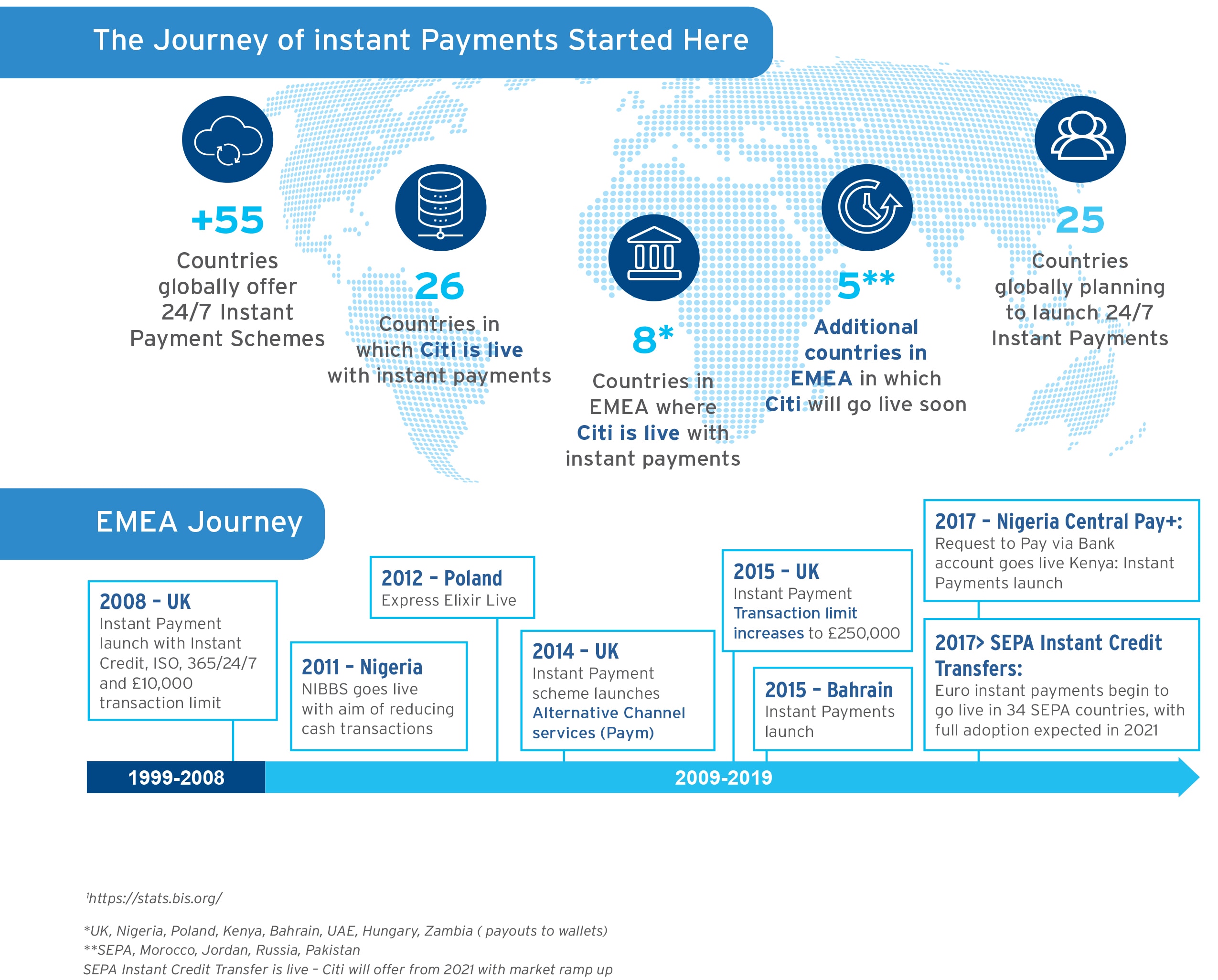

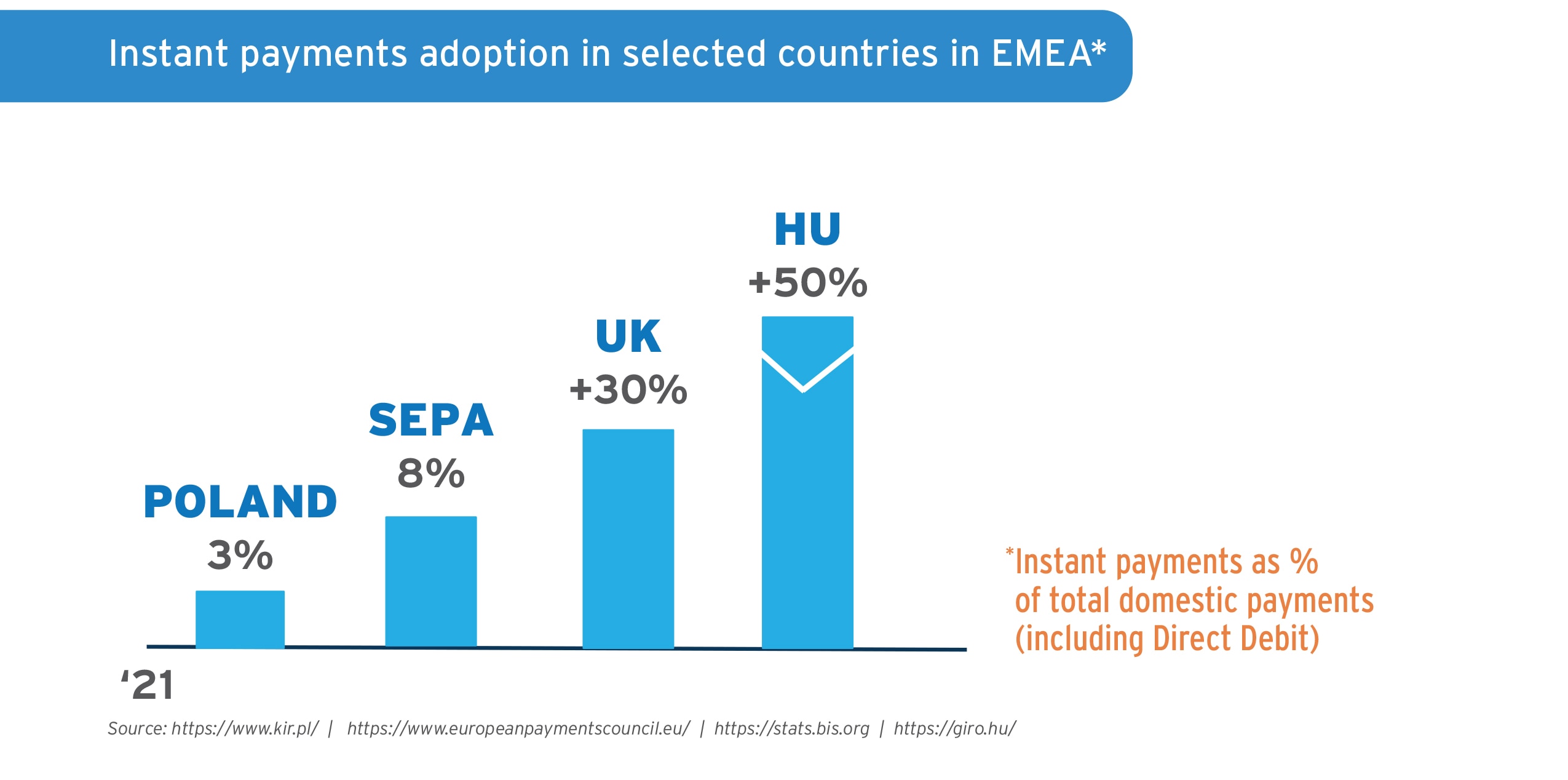

The instant payment landscape across EMEA has been transformed since 2008 when the UK launched Faster Payments. Today, there are 16 instant payment systems operating in EMEA and more are on the way. Among the most important recent developments in the region are the SEPA Instant Credit Transfer (SEPA SCT Inst), a Pan-European, euro-denominated instant payment solution, which launched in November 2017. In March 2021, it had 2,301 payment service providers (PSPs) from 23 countries in Europe, that is 58% of the total number of SCT participants in SEPA and 68% of SCT participants in the euro area. Some observers believe SCT Inst could ultimately become the default payment instrument for consumers and businesses in Europe.The growth of instant payments reflects the increase in mobile use across EMEA and consumers’ rising expectations for real-time transactions. However, different countries within EMEA also have specific objectives that are helping to drive adoption. For instance, the UK’s Faster Payments has the goal of building a digital culture and cashless society to improve payment efficiency. The implementation of a consistent offering across banks and the decision by the UK government to embed it for public services, including benefits and tax collections, has ensured this objective is well on the way to being met: there were 2.4 billion transactions in 2019 (19% YoY growth) with a total value of £1.9 trillion (14% YoY)1.

Meanwhile, in the Middle East regulators and governments are rolling out a full suite of payment services, ranging from high value to instant payments, in order to enhance competitiveness. In other markets the objective is to enable financially excluded people to enter the economy, through the use of e-commerce channels and mobile. Nigeria’s NIBSS Instant Payments (NIP) service, launched in 2011, offers accountto- account funds transfer that guarantee instant value to the beneficiary. The service is available to both consumers and corporates and growth in use has been impressive given limited bank account penetration in the country. Importantly, NIP is offered by all major banks operating in the country and is promoted as a safe, convenient and efficient method for moving funds and reconciling accounts.

The Hungarian market is an excellent example, of the local regulator paving the way for adoption of instant payments. As far as Hungary is concerned, all domestic payments in local currency, below the threshold of 10 million HUF must be routed as instant payments per local regulation. The result is impressive as instant payments account for more than 50% of total domestic transactions now. It does not stop there as the banking industry is going to leverage payments infrastructure for other, convenient services for e-commerce like Request to Pay.

In the meantime, Express Elixir — the scheme launched in 2012 in Poland — noted three-digit-growth in 2020 for the third time in a row. The adoption of the scheme is predominantly driven by clients’ experience. Having said that, convenient mobile payments that leverage instant payments rails and proxy IDs (a telephone number) are driving adoption. At present, mobile P2P payments account for more than 80% of total instant payments volumes in the market. However, consumers’ experience is influencing B2C or C2B flows as well. Corporates have already spotted the trend and opportunity to differentiate their own services thanks to improved clients’ experience especially in the insurance or e-commerce industries.

Why instant payments make sense for companies

While instant payments in much of EMEA were initially focused on consumers, they are increasingly important for both large corporates and small and medium-sized enterprises (SMEs). Businesses in all sectors are moving to a 24/7 world and therefore need to embed suitable payment methods into their architecture. Most obviously, companies need to accommodate changing consumer preferences, those unable to offer consumers their preferred payment methods risk losing business.

Moreover, companies must keep up with changes in the clearing landscape, many of which are making instant payments more suitable to corporate use. For instance, a number of instant payment systems have increased payment limits. The best example is the Target Instant Payments System (TIPS), which is an infrastructure operated by Eurosystem based on the SEPA Instant Credit Transfer (SCT Inst); it has no upper limit for payments unless participants agree to an individual threshold. Another eurozone player, EBA Clearing, which operates the RT1 infrastructure, increased its SCT Inst limit from €15,000 to €100,000 in July 2020 and allows participants to agree to a higher threshold to facilitate increased B2B flow. The UK’s Faster Payments Service scheme provider, which currently offers one of the highest thresholds of GBP 250,000, is also aiming to increase it up to GBP 1 million in 2021.

At the same time, recent efforts to further accelerate adoption and the reachability of SCT Inst have focused on pan-European interoperability, which is advantageous for corporates. The European Central Bank (ECB), with support from the European Commission, has allowed auxiliary systems (such as ACHs, for example, EBA Clearing with RT1 infrastructure) to join TIPS and to migrate operating accounts from Target2 to TIPS infrastructure. In parallel, the ECB’s Governing Council has recommended that PSPs migrate settlement accounts to TIPS infrastructure as well.

TIPS is therefore set to become the common SEPA Instant Payment infrastructure to facilitate SCT Inst and 24/7 liquidity management across the SEPA ecosystem. In practice, this means that corporates will be able to initiate or receive SCT Inst transactions from one bank account to another across a majority of the banks across the SEPA region.

How instant payment act as an enabler of real-time treasury

The speed of instant payments — with settlement typically occurring in under 10 seconds — offers an opportunity for treasurers to create value and exercise far greater control. Making payments when necessary, rather than having to accommodate two- or three-day processing times, can boost working capital and minimize idle balances. Supplier payments can be synchronized more closely with the production cycle, helping companies to embrace just-in-time business models. Instant payments not only offer treasurers the opportunity to improve disbursements; they can enable real-time collections too, with instant payments offering finality of settlement, due to their irrevocability. Insurance companies can receive premiums and settle claims instantly providing an enhanced customer experience, driving customer retention and attracting new business.

Moving to instant payments can be a key driver of a broader move to a real-time treasury, creating a streamlined operation that is more responsive to the business, more efficient (instant payments can be seamlessly integrated into an ERP system, for instance), and has better visibility of both cash flow and risk. Instant payments, when coupled with application programming interfaces (APIs), are unlocking exciting new opportunities. APIs and enhanced data enable corporates to reconcile in near real-time, lowering days sales outstanding (DSO) and improving liquidity. Companies are increasingly embracing this technology to create new products to supplement their business and/or enhance their customers’ or employees’ experience with faster turnaround on financial fulfilment. For gig economy employees in food delivery or ride hailing, the ability to request payment for services enables immediate settlement and gives companies an advantage over competitors in hiring and retaining staff.

The future is instant

Instant payments are already a significant payment method for consumers in many countries in EMEA and are rapidly becoming so for companies in the region. As our lives increasingly move online (and go mobile) real-time transactions will only continue to grow in importance.

For corporates and SMEs, keeping up with changes in the payments landscape is critical, customers and suppliers increasingly expect real-time payments and information. Most importantly, instant payments offer many benefits for companies as they transition to an always-on business environment. Instant payments can be the foundation of a real-time treasury operation, which offers enormous advantages in terms of visibility, control and improved working capital.