Home of the Future 2

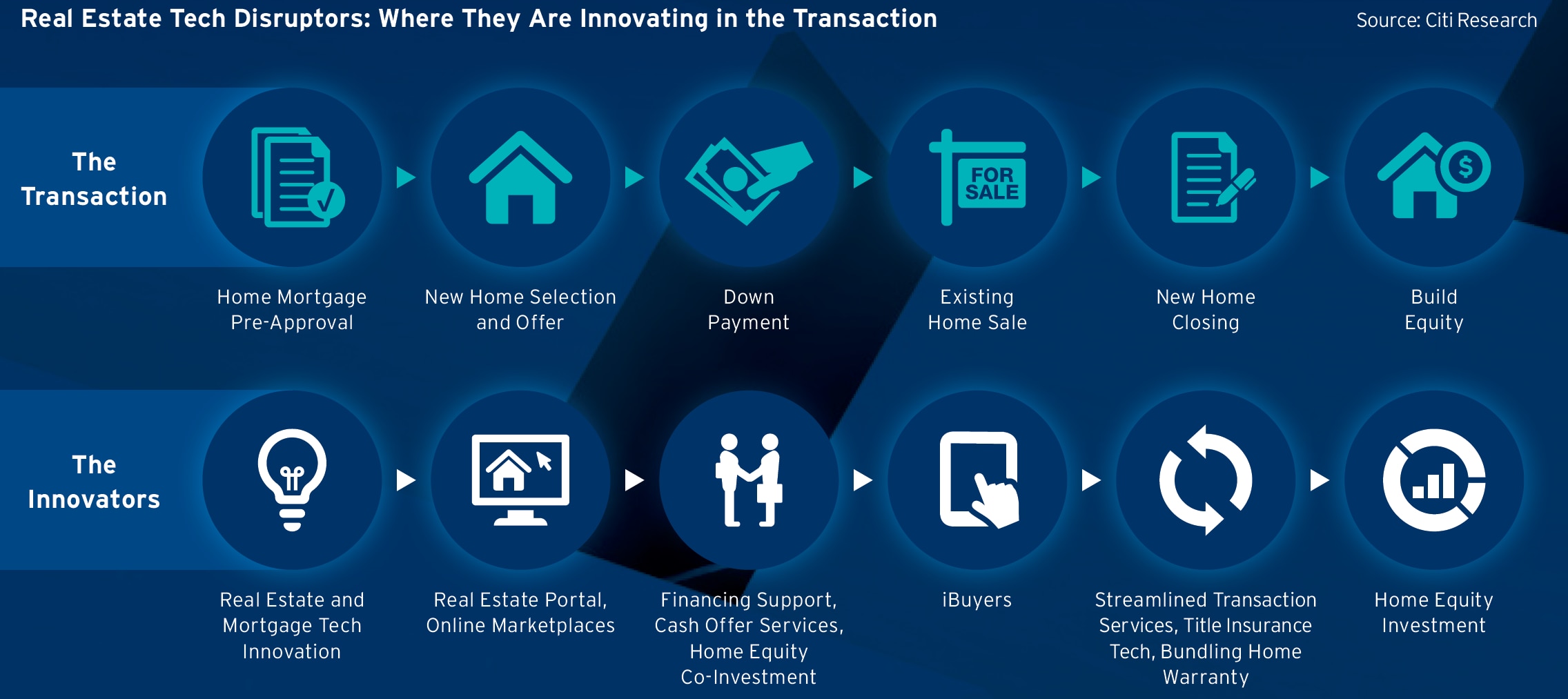

In our first Home of the Future report Building for Net Zero, we looked at innovation in homebuilding. In this new report, we turn our attention to innovation in the housing market. If you bought or sold a house in the past 20 years, it was likely a memorable experience. It typically includes dealing with real estate agents, mortgage brokers, title companies, insurance companies, lawyers, housing inspectors, and country clerks. There tends to be very little technology utilized throughout the process, and when it finally comes to closing day, you are faced a huge stack of documents that needed to be signed, initialed, stamped, and certified.

For most people, buying a home is the biggest financial transaction they will make in their lifetime. This fact alone can lead to stress even before the buying process begins. The path to becoming a homeowner often starts with personal decisions like choosing a location, assessing how much to spend on a home, and deciding how much of the purchase price to finance. This is followed by finding a real estate broker, going to open houses, finding the right house, negotiating a purchase price, securing financing, and closing the transaction. The whole process gets even more complicated if the new house purchase relies on the sale of an existing house.

Despite many industries welcoming the advancement of technology over the past decades, the process of buying and selling a home has for the most part remained unchanged. Real estate listings migrated online and home searches can now be done from the comfort of the sofa, but large-scale technological changes have not occurred. Given the housing market is hyperlocal by nature and heavily regulated, the potential upside from innovation seems limited. There is also a feeling that players are too small to benefit from innovation at scale.

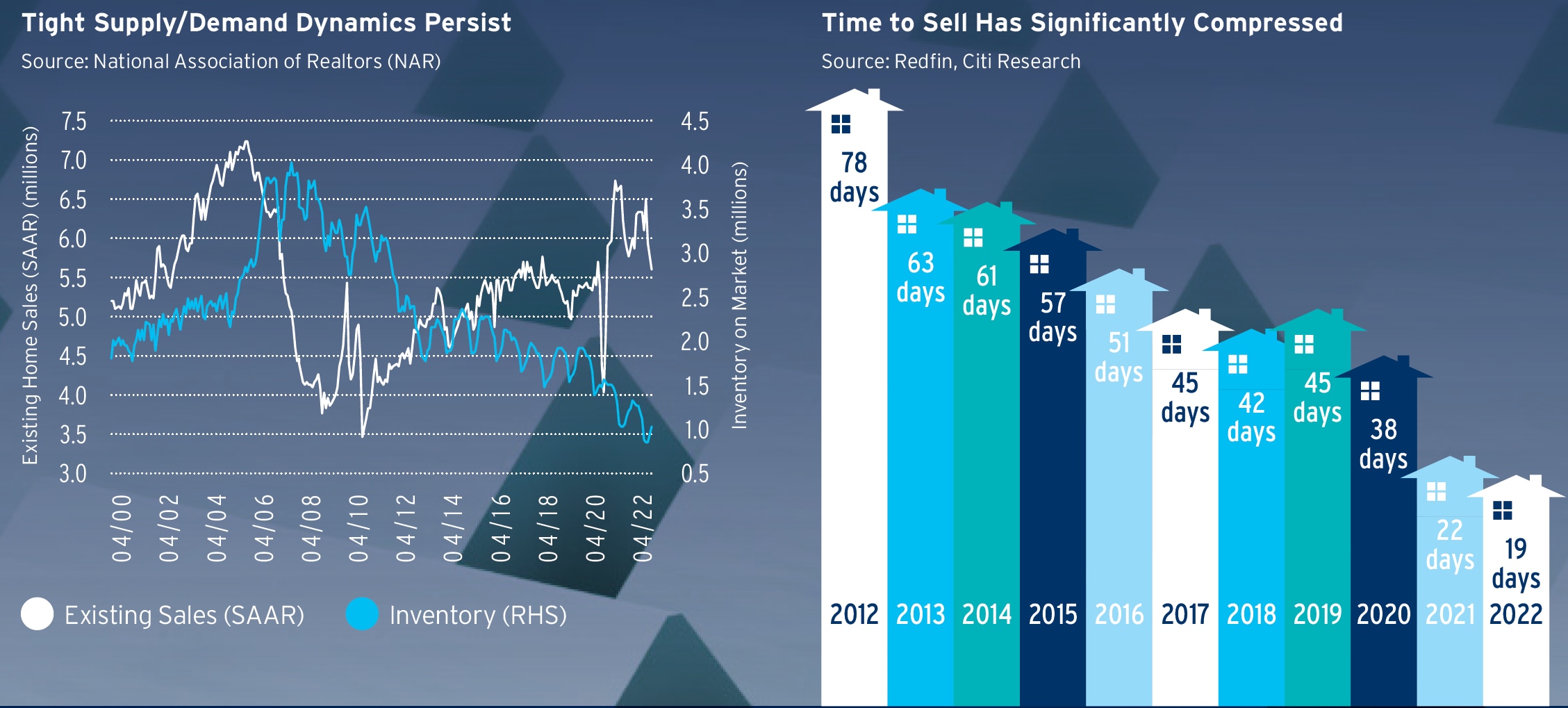

Similar to other industries, however, the pandemic has acted as a catalyst for change in the housing market. The prospect of remote work and the rush to move away from congested cities has led to growing demand in a housing market that already had tight supply. This has led to a significant decline in the amount of time houses spend on the market and stretched housing affordability.

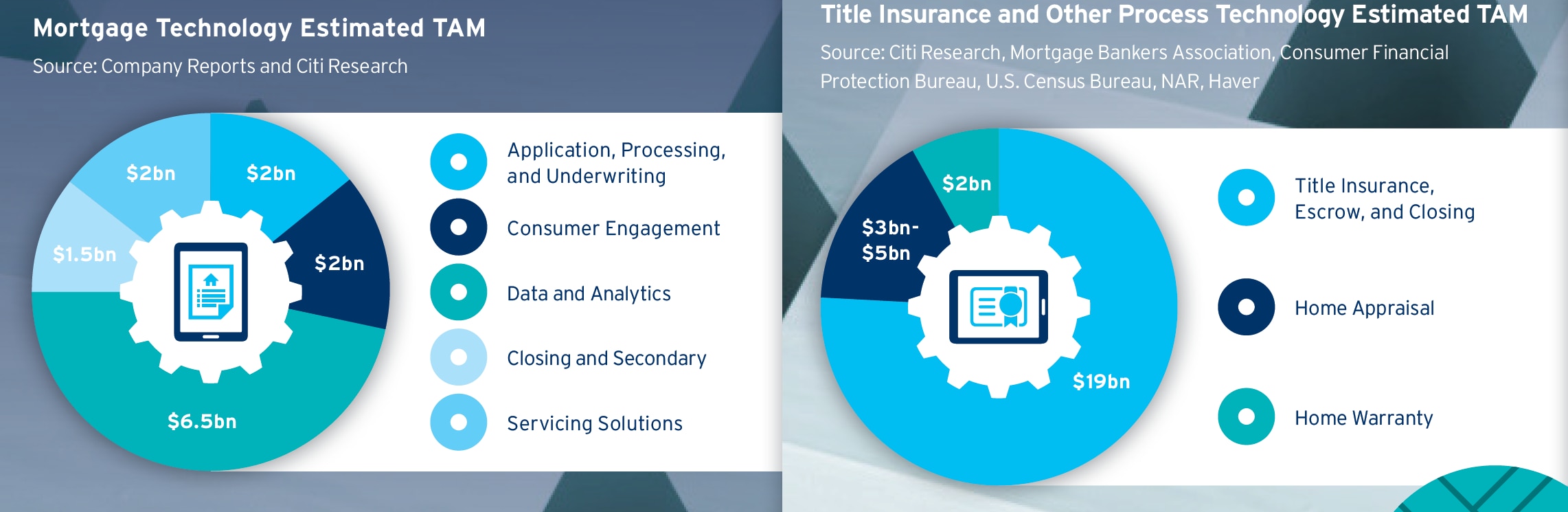

Supply-demand imbalances and affordability factors are driving technology adoption into the housing market. PropTech, or fintech for real estate, is being incorporated across the home buying experience to make real estate transactions more efficient. The total addressable market (TAM) for mortgage technology is an estimated $14 billion and the technology developed to make the mortgage process more efficient could lead to cost savings for mortgage originators, faster loan closing times, and faster processing times.

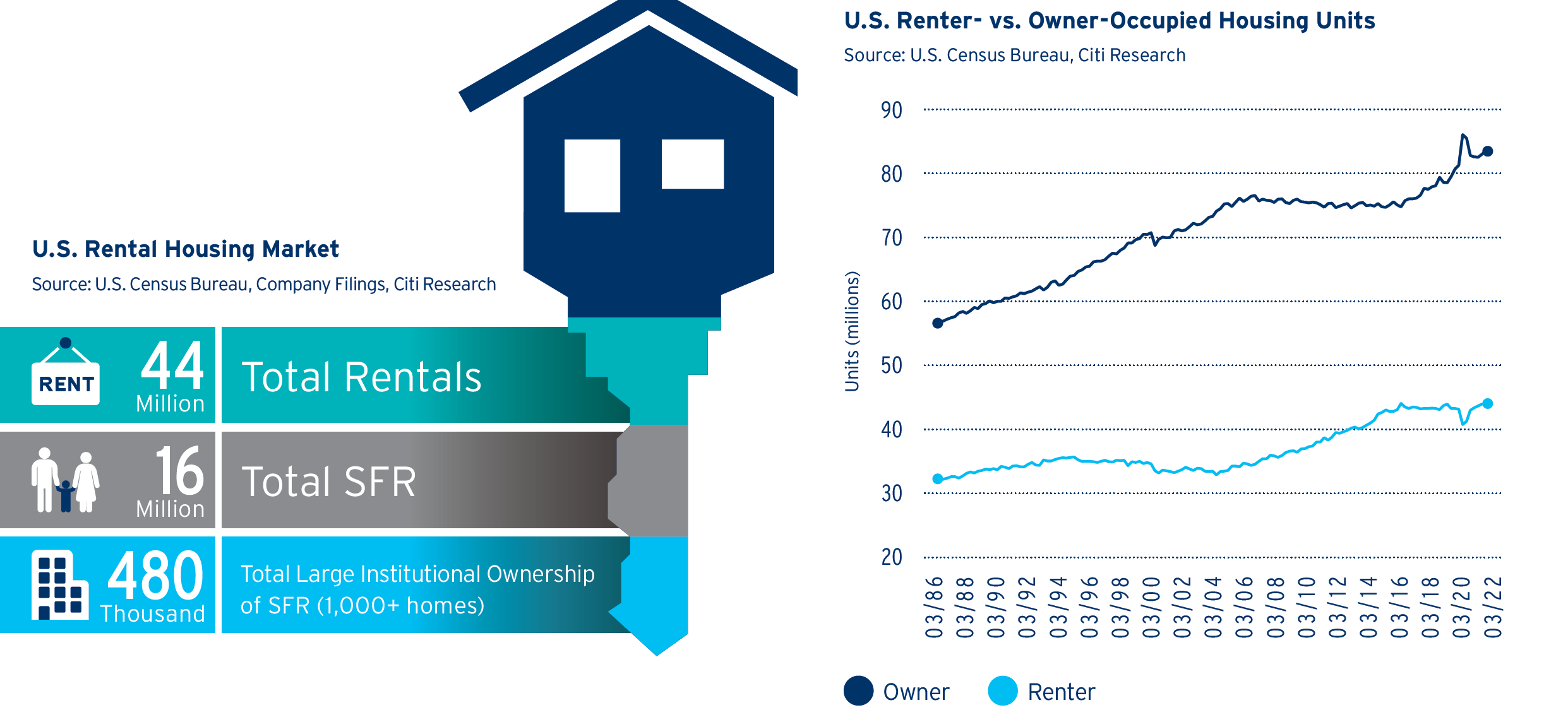

New PropTech solutions to help buyers finance their transactions and better manage the timing logistics when both buying and selling a home are also starting to take hold. Finally, the increase in institutional ownership in the rental market is driving the use of efficiency technology in property management. As a larger share of single-family rental homes are held by institutions, they are utilizing technology platforms to manage things like repairs and security, and maximizing efficiencies and profit margins.

Strengthening the foothold of technology in the real estate market should help move the industry towards being “frictionless” and potentially drive democratization of information and data while improving on the legacy ways of doing business.

Authors: Anthony Pettinari,Roger Ashworth,Michael Bilerman,Renata Cabral,Griffin Chan,Arren Cyganovich,Ami Galla,Nicholas Jones,Cindy Li,Chris Marazzo,Andre Mazini, CFA,Ken Yeung,

Why Innovate in Housing?

Innovation in the Housing Ecosystem

Innovating Finance and Process Tech

Innovating Property Management