Money, Tokens, and Games

test 2 Can you always spot disruptive innovation? When we hear the story of how the invention of the automobile hastened the demise of buggy whip companies, we often question why the disruptive potential of gas-powered cars wasn’t noticed. In the modern era, most people buying digital cameras in the 1990s would have scoffed at the idea that in a few years’ time, we would all be carrying around cameras in our mobile phones.

The potential for tokenization via blockchain has been talked about as being transformative for the past few years but we are not quite at the point of mass adoption. Unlike automobiles or more recent innovations like ChatGPT or the Metaverse, blockchain is a back-end infrastructure technology without a prominent consumer interface, making it harder to visibly see how it could be innovative.

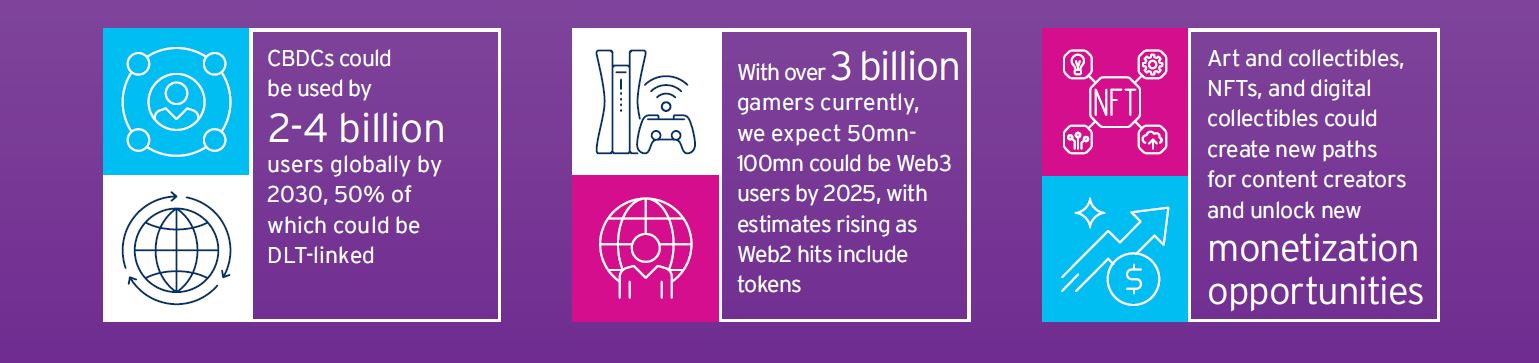

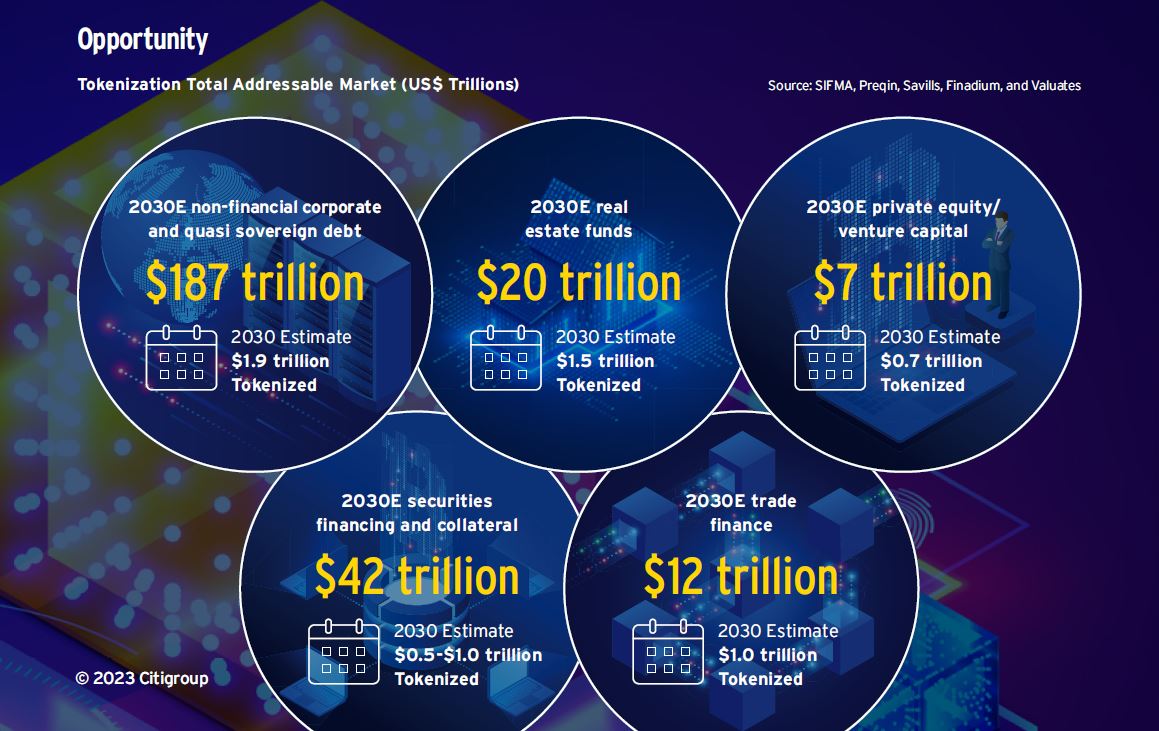

But we believe we are approaching an inflection point, where the promised potential of blockchain will be realized and be measured in billions of users and trillions of dollars in value. Successful adoption will be when blockchain has a billion-plus users who do not even realize they are using the technology. This is likely to be driven by the adoption of central bank digital currencies (CBDCs) by large central banks as well as tokenized assets in gaming and blockchain-based payments on social media. By 2030, up to $5 trillion of CBDCs could be circulating in major economies in the world, half or which could be linked to distributed ledger technology. Tokenization of financial and real-work assets could be the killer use case driving blockchain breakthrough with tokenization expected to grow by a factor of 80x in private markets and reach up to almost $4 trillion in value by 2030.

We first wrote about tokenization in the 2021 Citi GPS report Future of Money: CBDCs, Crypto, and 21st Century Cash. At the time, China was starting to pilot test its (CBDC) and other central banks were warming up to the idea of their own digital currencies. In recent months, central banks in multiple large countries have announced plans for CBDCs this decade, giving almost 2 billion people the opportunity to experiment with digital currency.

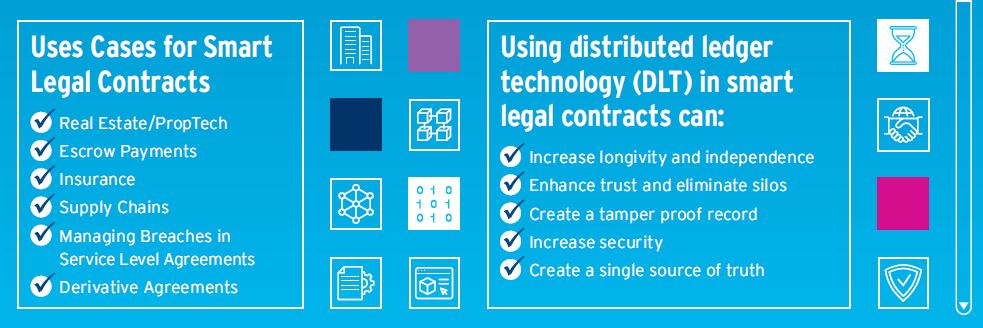

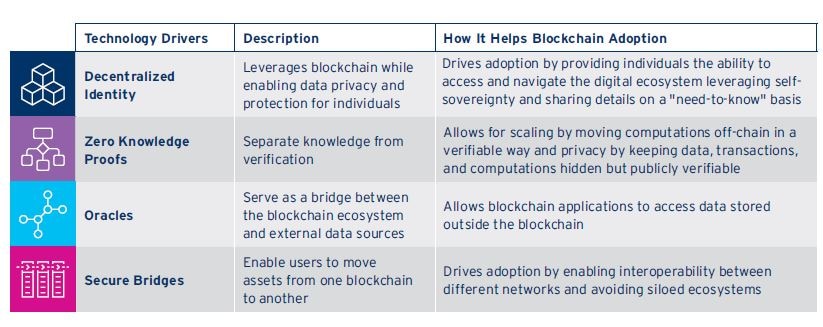

To be successfully adopted into the mainstream, blockchain needs the help of technology enablers, including (1) decentralized digital identities, (2) zero-knowledge proofs, (3) Oracles, and (4) secure bridges. The legal plumbing also needs to be altered to enable smart legal contracts that will provide a whole new set of rails for global commerce and finance to run on. Regulatory considerations are also necessary to allow adoption and scalability without the hindering innovation.

Although we think mass adoption could still be six to eight years away, momentum on adoption has positively shifted as governments, large institutions, and corporations have moved from investigating the benefits of tokenization to trials and proofs of concept.

Billions of Users

Trillions in Value

Technology Enablers

Legal Enablers